Micron CEO Sanjay Mehrotra speaks before President Joe Biden delivers remarks on the CHIPS and Science Act and his Investing in America agenda, at the Milton J. Rubenstein Museum in Syracuse, New York, April 25, 2024.

Andrew Caballero-Reynolds | AFP | Getty Images

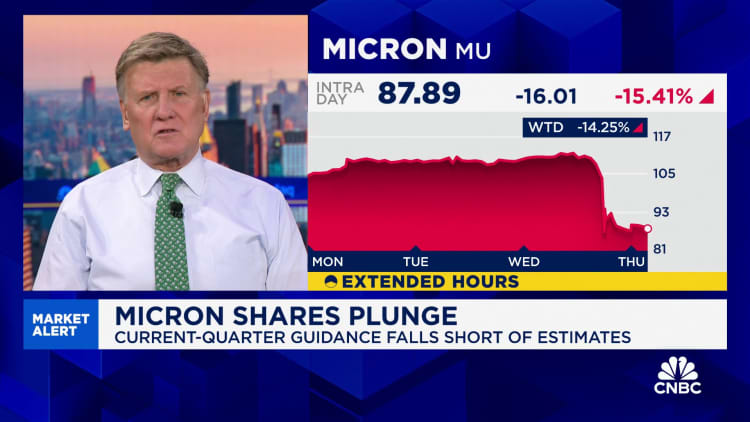

Micron shares plummeted 16% on Thursday — their worst day since March 2020 and the start of the Covid pandemic — after the chipmaker issued disappointing second-quarter guidance in its earnings report.

The stock fell to $87.09 at the close, about 45% down from its all-time high in June.

For the fiscal second quarter, Micron said it expects revenue of $7.9 billion, plus or minus $200 million, and adjusted earnings per share of $1.43, plus or minus 10 cents. Analysts were expecting revenue of $8.98 billion and EPS of $1.91, according to LSEG.

On the earnings call, CEO Sanjay Mehrotra said the company, which provides computer memory and storage, is seeing slower growth in parts of consumer devices and is experiencing “inventory adjustments.”

“Micron expects further delay in the PC refresh cycle and cited pockets of elevated customer inventory in smartphones,” analysts at Stifel wrote in a report to clients. The firm kept its buy rating on the stock but lowered its price target to $130 from $135.

Micron reported an earnings beat from the first quarter, with earnings per share coming in at $1.79, topping the $1.75 average analyst estimate. Revenue jumped 84% from a year earlier to $8.71 billion, meeting estimates. The growth was driven by a 400% increase in data center revenue due largely to demand for artificial intelligence, Micron said.

“We continue to gain share in the highest margin and strategically important parts of the market and are exceptionally well positioned to leverage AI-driven growth to create substantial value for all stakeholders,” the company wrote in its report.

WATCH: Micron shares plunge