A PayPal sign is seen at its headquarters in San Jose, California, on Jan. 30, 2024.

Justin Sullivan | Getty Images News | Getty Images

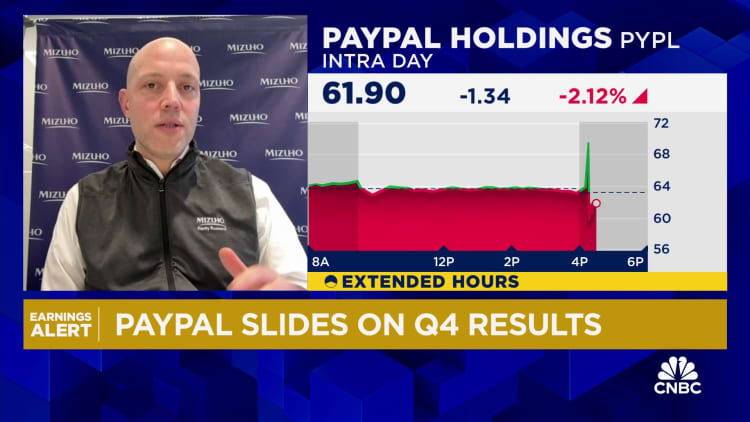

PayPal reported better-than-expected fourth-quarter results Wednesday, but issued guidance that was a bit below estimates. The shares slid 8% in extended trading.

Here’s how the company did:

- Earnings per share: $1.48 adjusted vs. $1.36 expected by LSEG, formerly known as Refinitiv

- Revenue: $8.03 billion vs. $7.87 billion expected, according to LSEG

Revenue increased 9% in the quarter from $7.38 billion a year earlier. The number of active accounts fell 2% to 426 million, trailing analyst expectations of 427.17 million, according to StreetAccount.

Net income rose 52% to $1.4 billion, or $1.29 per share, from $921 million, or 81 cents per share, a year earlier.

The company reported total payment volume of $409.8 billion for the quarter, up 15% from the prior year and surpassing the $405.51 billion expected by analysts polled by StreetAccount.

PayPal provided guidance for the full year and first quarter that fell just short of expectations. The company anticipates full-year earnings of $5.10 per share, below the $5.48 analysts expected, according to LSEG.

For the first quarter, PayPal estimated year-over-year earnings per share growth would fall in the mid-single digits, compared with a consensus estimate of 8.7%.

Finance Chief Jamie Miller said on the earnings call that the company will stop providing annual guidance, and instead just provide an outlook for the current quarter.

“Given the considerable changes underway at the company, we believe it is prudent to guide revenue one quarter ahead and provide updates as the year progresses,” Miller said.

PayPal announced last week that it would cut 9% of its global workforce, or about 2,500 jobs. Last month, the company introduced new artificial intelligence features, the first major announcement under CEO Alex Chriss, who called it the start of the company’s “next chapter.”

“We’re driving significant transformation across our company and are committed to making the necessary changes to our business to drive profitable growth in the years ahead,” Chriss, a former Intuit executive, who was named CEO in August, said in the earnings release.

Shares of PayPal are up 3% this year as of Wednesday’s close after falling for three straight years. They’re about 80% off their record from July 2021.

WATCH: PayPal slides on Q4 results