The New York Stock Exchange welcomes Snowflake to usher in the first day of winter on Dec. 21, 2021. To honor the occasion, Snowflake the Bear, joined by Chris Taylor, vice president of NYSE Listings and Services, rings the opening bell.

NYSE

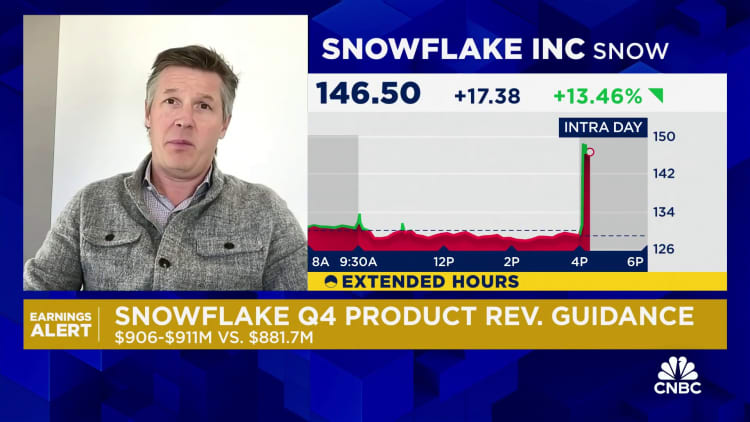

Snowflake shares on Wednesday spiked 19% in extended trading after the data analytics software maker reported fiscal third-quarter earnings that beat estimates.

Here’s how the company did, compared to LSEG analyst expectations:

- Earnings per share: 20 cents, adjusted vs. 15 cents expected

- Revenue: $942 million vs. $897 million expected

Snowflake’s revenue rose 28% year over year in the quarter, which ended on Oct. 31, according to a statement. The company’s net loss of $324.3 million, or 98 cents per share, widened from $214.3 million, or 65 cents per share, in the same quarter a year earlier.

Separately, Snowflake announced a multi-year partnership with Anthropic, the Amazon-backed artificial intelligence startup and OpenAI competitor. And it said it had agreed to buy startup Datavolo for undisclosed terms.

The company’s second-quarter earnings report, released in late August, beat Wall Street’s estimates on earnings but showed decelerating growth in product revenue compared to prior quarters.

As of Wednesday’s close, the stock was down 35% so far in 2024, while the S&P 500 index was up 24%.

Executives will discuss the results with analysts on a conference call starting at 5 p.m. ET.

This is breaking news. Please check back for updates.

WATCH: Q3 is one of Snowflake’s ‘best quarters we’ve seen in a long time’, says Jefferies Brent Thill